Budgeting that

stays on your computer.

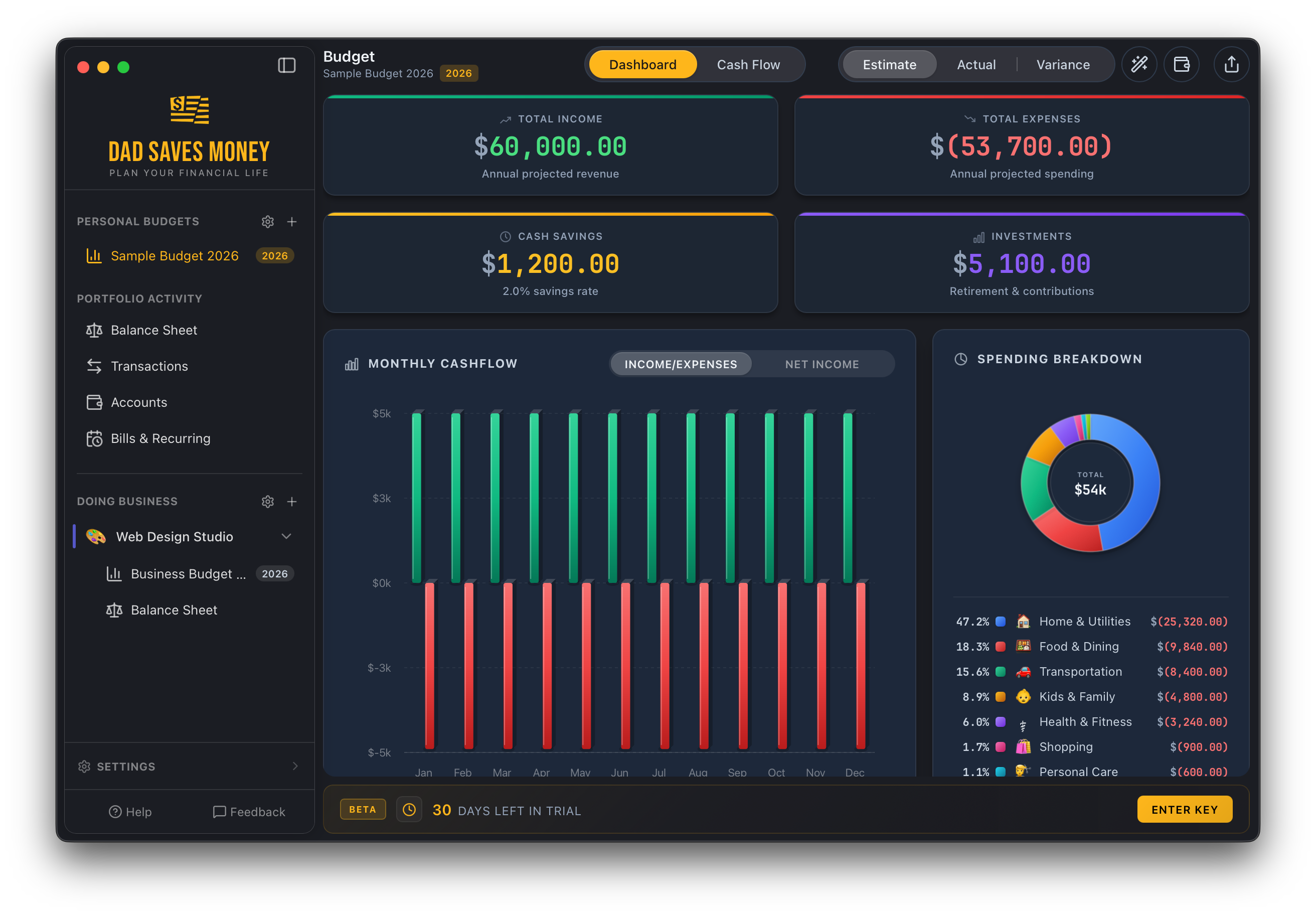

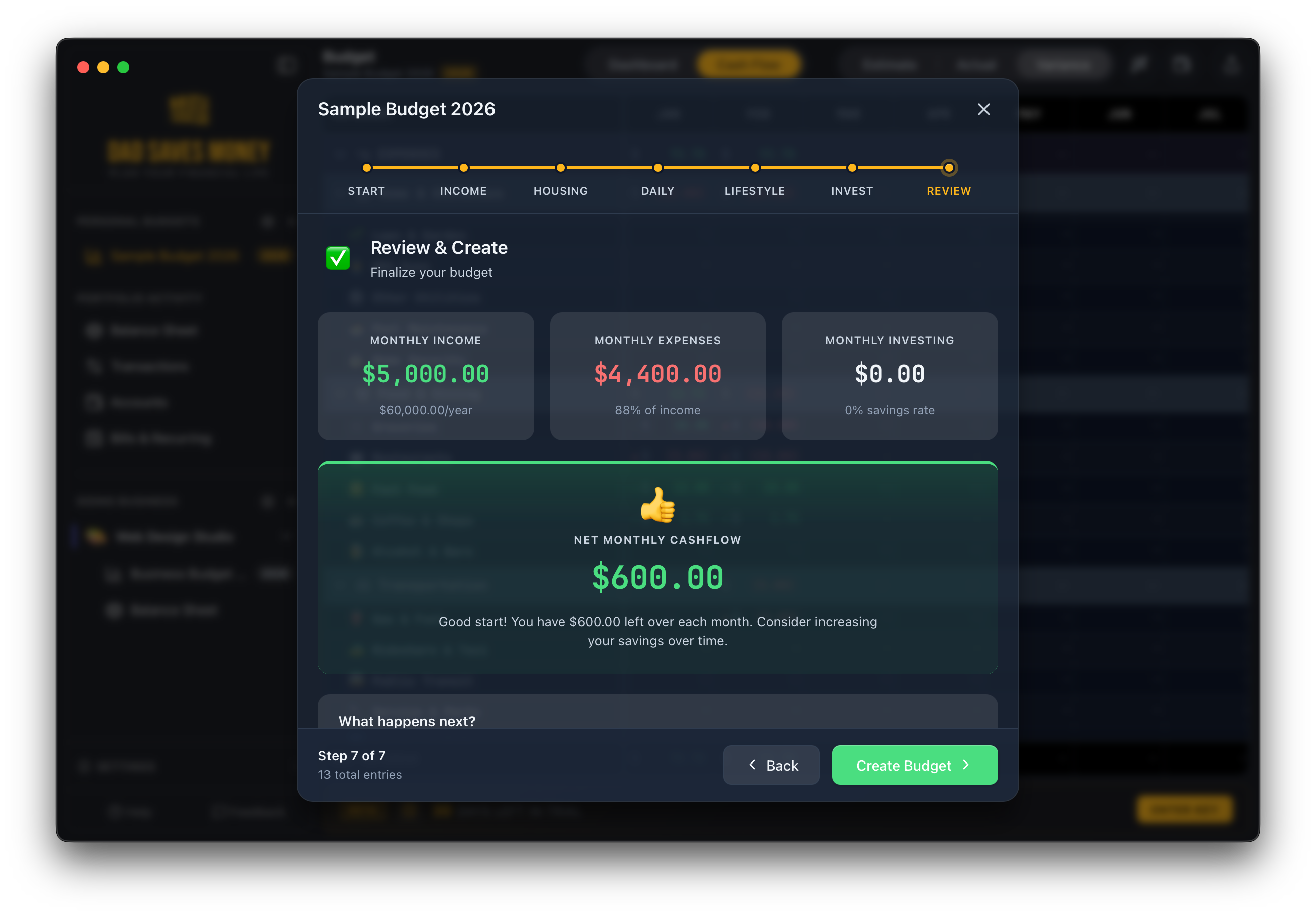

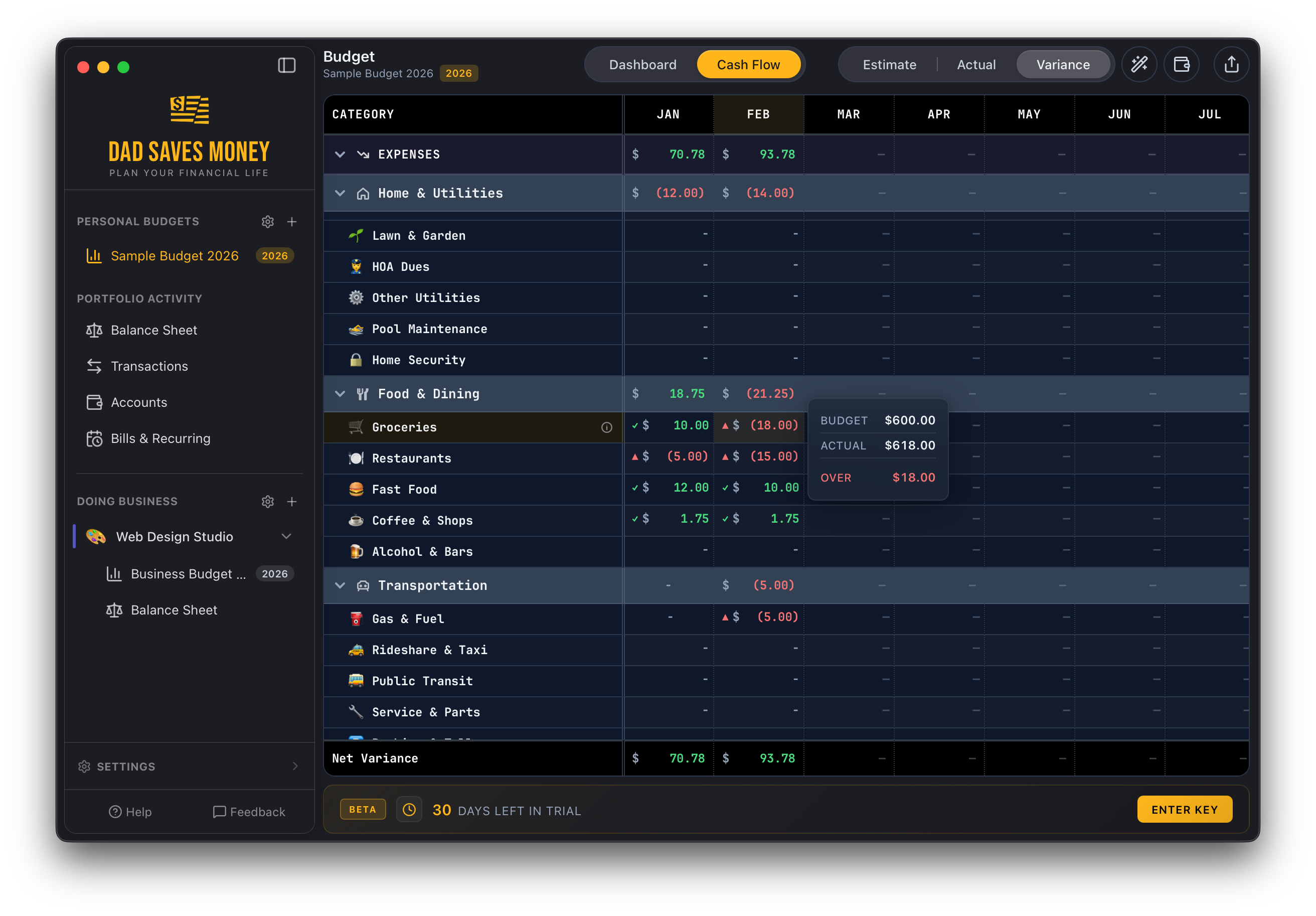

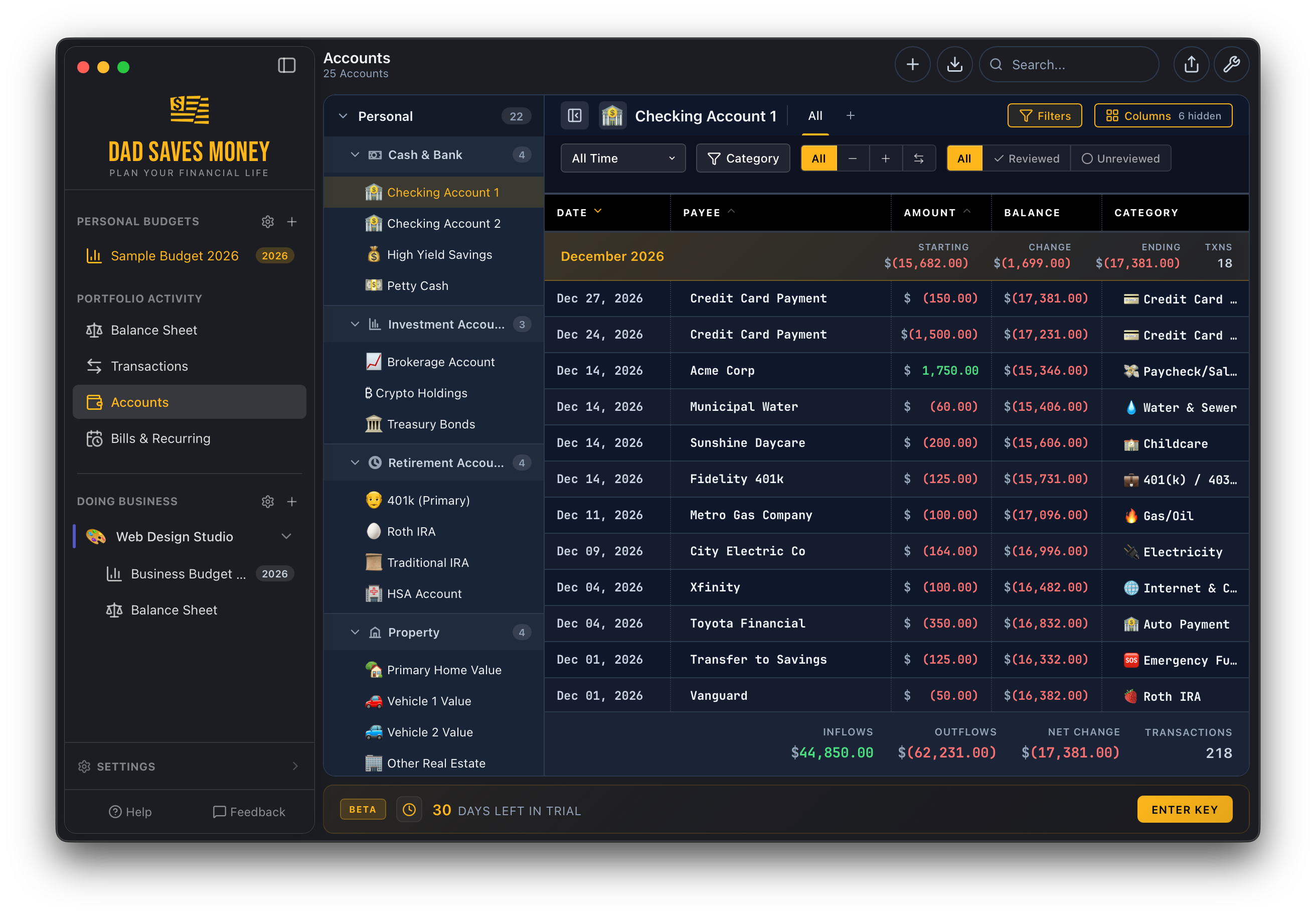

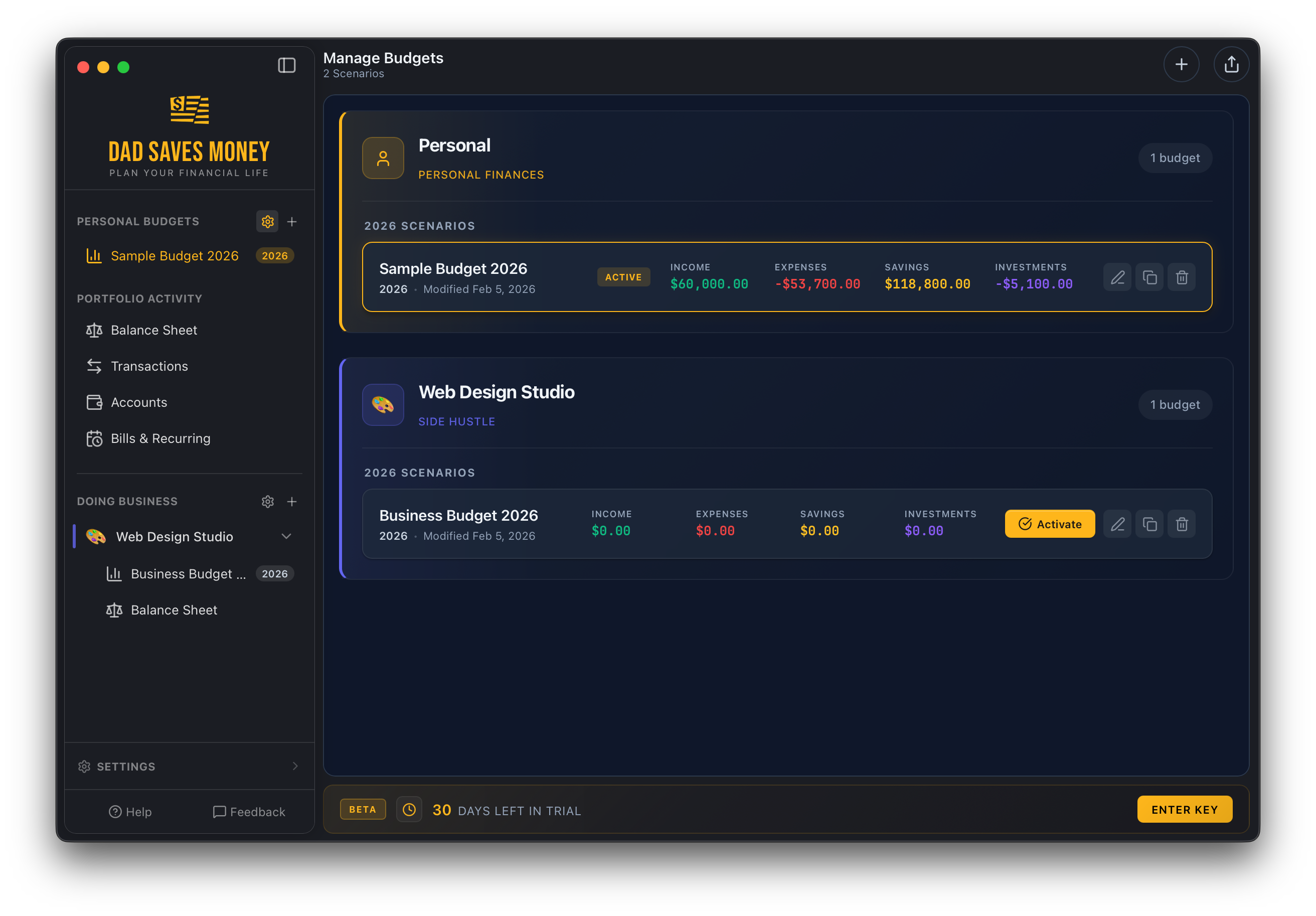

A powerful, private desktop app for planning your financial life. Track personal and business budgets, import bank transactions, and see exactly where your money goes.

Free 30-day trial. No account required. No data leaves your machine.